Attractiveness of Lower Middle Market Companies for Mergers & Acquisitions

The Lower Middle Market (LMM) is brimming with deal opportunities. These companies are a very attractive segment for financial and strategic investors due to the availability of a larger pool of companies, the ability to be acquired at more reasonable valuations, and the aging of the baby boomers, who typically are the owners of these companies.

What is Lower Middle Market?

Lower Middle Market Companies are generally owner-operated businesses with revenue of between $5 million and $50 million. These companies are in diverse industries and are generally profitable. These companies often provide a niche or targeted offering/product to their end customers. Another characteristic of the Lower Middle Market companies is that they tend to gravitate towards more recession-resistant industries like healthcare, distribution, heating and ventilation, waste management, etc.

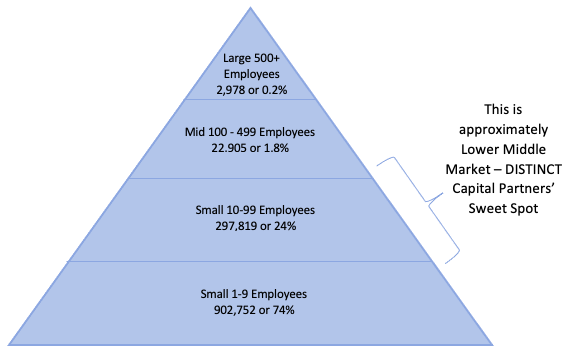

According to Key Small Business Statistics 2020 by Innovation, Science and Economic Development Canada Small Business Branch Research and Analysis Directorate, as of December 2019, there were 1.23 million employer businesses in Canada. With a significantly large percentage of these businesses being small to lower middle-market businesses.

Attractiveness of Lower Middle Market Companies

As discussed previously, there is a greater pool of available lower middle market companies as they are predominantly owned by the baby boomers. The baby boomers are looking to transition or slow down as they get closer to retirement. Their children are often not interested in taking over the family business and are pursuing either a professional career or their own business venture. Also, these businesses typically do not have a C-Suite type of management system.

Valuations tend to be a little lower in the lower middle market due to a desire to quickly exit, size, customer concentration, lack of managerial support, and inadequate procedures and controls. Also, competition in the upper end of the market drives valuation in that segment a little higher. Lower valuation and the ability to derive better synergies affords a better return on investment for acquirers.

The strategics are attracted to this segment as it allows them to make tuck-in acquisitions to obtain either economy of scale or product or geographic expansion. Also, the ability of strategics to create synergistic value is much higher. For private equity firms, a large portion of their portfolio investment is built on the “buy and build” strategy. This involves the purchase of a platform portfolio company followed by strategic tuck-in acquisitions (generally lower middle-market companies) which complement and grow the platform company.

What Does This Mean for Lower Middle Market Owners?

The market for mergers and acquisitions (buying or selling a business) remains robust even during the pandemic. The following charts based on US Lower Middle Market activity demonstrate how the activity was impacted during the 2nd and 3rd quarter of 2020 and recovery since.

The Canadian market which closely resembles the trends in the US market has demonstrated a similar pattern of recovery.

Source: SDR Ventures – Private Equity Roundtable: State of the Lower Middle Market

Going forward, barring any Black Swan like event, we at DISTINCT Capital Partners believe that mergers & acquisition activity will continue to remain robust in the Lower Middle Market segment due to:

Businesses that were on the sideline last year but are now looking to sell as their business/earnings normalize

Valuation multiples rebounding to around pre-pandemic levels for most industries

Lower Middle Market Companies are smaller, less risky, and don’t require a large amount of leverage for acquisition

Significant demand for good businesses from private equity firms and strategic buyers

Easy access to capital due to continued low-interest rates and ample liquidity provided by government initiatives across the globe.

Why DISTINCT Capital Partners?

DISTINCT Capital Partners has specialized in advising owner-operated lower middle market companies for over 25 years. Our team members have prior experience working for strategics and/or financial investors and understand their operating model. This enables the team at DISTINCT Capital Partners to best advise business owners to get prepared for the sale process and proficiently guide them through the entire sale process.

For the two most recent transactions we closed, we were the exclusive advisors to owners of Lower Middle Market companies:

Advisor to ThoughtSpeed eCommerce Ltd. with the sale of its Canadian healthcare software assets to the Canadian Pharmaceutical Distribution Network (CPDN).

Advisor to Excel Transportation in its sale to TFI International Inc.

If you are interested in learning more about selling or buying a business, please contact us at (905) 827-1880 or info@distinctcapitalpartners.com.